BRAD RAINES

Principal Investment Advisor

Here at Applied Capital

I founded Applied Capital in 2013 as a SEC Registered Investment Advisor (RIA) firm with a simple mission: to provide a modern investment platform where highly proficient, ethical advisors can better serve their clients. Since then, the firm has grown steadily, including the addition of a second office in Nashville, TN, in 2015 and an acquisition in 2021. We've built an exceptional team of investment advisors and support staff who are united by a shared focus—refining the process of investing and financial planning to deliver lasting value.

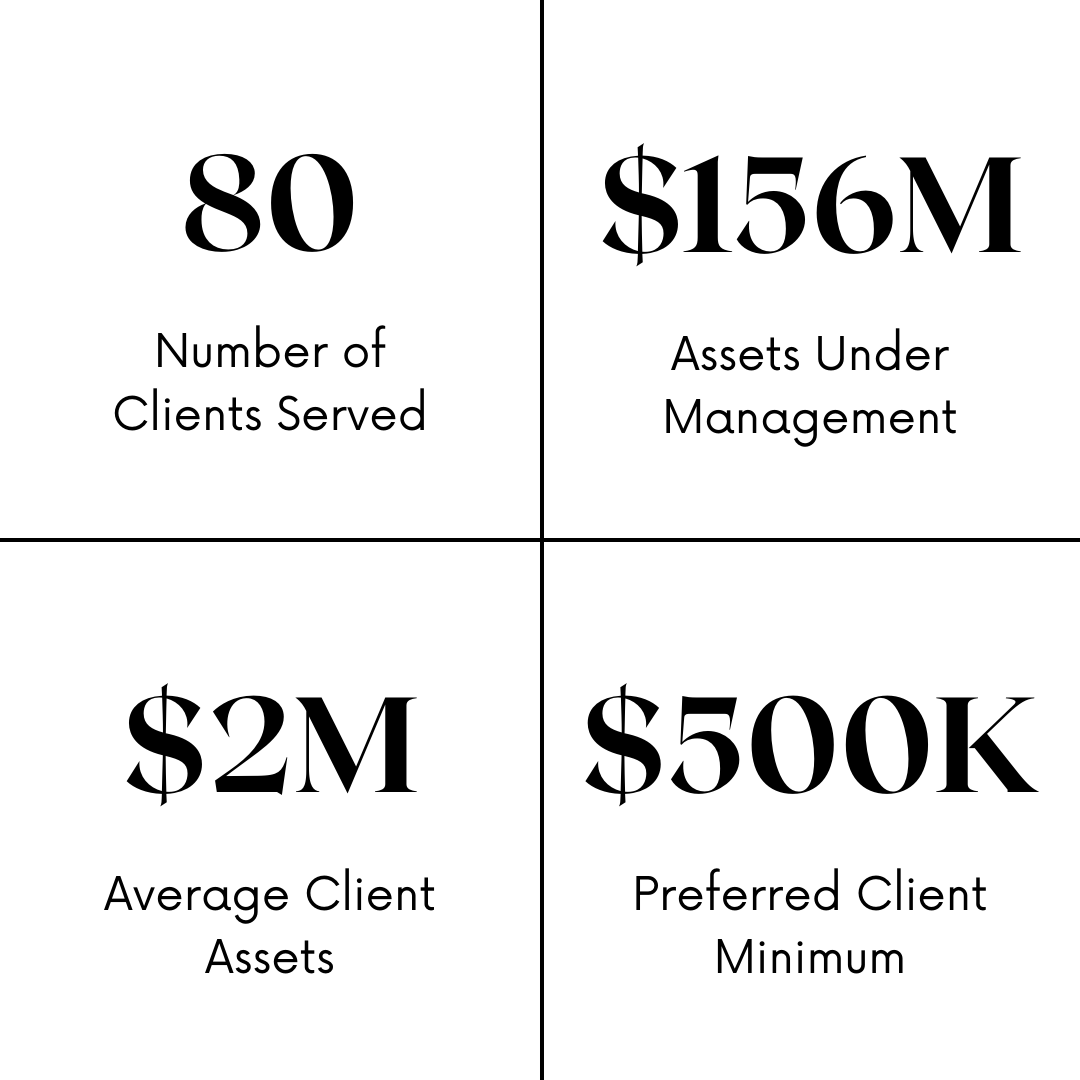

Whether working with physicians, professionals, business owners, or retirees, I begin every relationship by taking a comprehensive look at each client’s financial picture. From there, I build and implement efficient investment plans tailored to their specific goals and priorities. My personal practice emphasizes quality over quantity, allowing me the freedom to dedicate meaningful time to each client and develop long-term partnerships rooted in trust.

Under a transparent, fee-based compensation model, my financial motivation is directly tied to the success of my clients—their portfolio performance and, more importantly, the realization of their financial goals. I work best with high-income individuals who are disciplined savers and prefer to delegate or collaborate on the investment management with a trusted advisor.

With over 18 years of experience as an investment advisor, I remain focused on evolving Applied Capital through innovation and intentional growth. One of my favorite quotes by Henry Ford captures this mindset well: “The man who will use his skill and constructive imagination to see how much he can give for a dollar, instead of how little he can give for a dollar, is bound to succeed.”

Client capacity may be one of the most overlooked aspects of a successful advisory practice. Too often, advisors focus on quantity over quality—pursuing the fastest route to higher income, only to find themselves managing hundreds (or even thousands) of clients with limited time or attention for each. At this stage of my career, I choose to work exclusively with serious, long-term investors who are committed to productive, evidence-based strategies rather than chasing short-term predictions or market timing.

I often bring up the analogy of the gambler and casino, while encouraging my clients to shift their mindset more toward the latter to capture full market returns over time while avoiding unnecessary risk.

Education

Baylor University, BBA in Finance & Real Estate

Series 7 & 66 FINRA Licenses

Life, Health, and Long Term Care Insurance License

Background

I grew up in Waco, Texas graduating from Baylor University in 2006, where I also met my wife, Dr. Elizabeth Raines. She worked for many years as an audiologist at Arkansas Children’s Hospital. Together, we’re raising our four amazing kids—Grayson (2010), Graham (2013), Kate (2015), and Jack (2018)—and there’s truly never a dull moment.

Both Elizabeth and I were lifelong athletes, and I had the privilege of working with the Baylor Men’s Basketball Team during college. These days, knee surgeries have slowed me down on the court, but you’ll often find me coaching my kids’ basketball teams instead. I love the life lessons that team sports teach—from leadership and accountability to the belief that God has a unique Purpose, Plan, and Place for every child.

Outside of work I enjoy golf, tennis, fishing (even when nothing’s biting), exploring new tech, crawfish or shrimp boils, and spending time outdoors with family and friends.